After an investigation, which started in 2010, and has taken months of negotiating, five major lenders have reached a settlement with 49 states attorneys general and the federal government.

This historical $25 billion settlement is the largest consumer financial settlement in history, and was the result of investigations into mortgage servicing, foreclosure procedures and origination issues. The federal investigation included one of the most well known issues, robo-signing.

During the height of the foreclosure crisis, banks were unequipped to handle the volume of foreclosures. They routinely signed documents out of the presence of a notary public, and automated part of the process by having numerous people forging the signatures of bank officials to complete the foreclosure. There was a huge drop in foreclosures during the investigation. Now that the settlement has been reached, the banks will resume the foreclosure process with new guidelines and regulations.

What Does This Mean To You?

If you were foreclosed on between Jan. 1, 2008 and Dec. 31, 2011, you may be eligible for the onetime payment of $2,000.

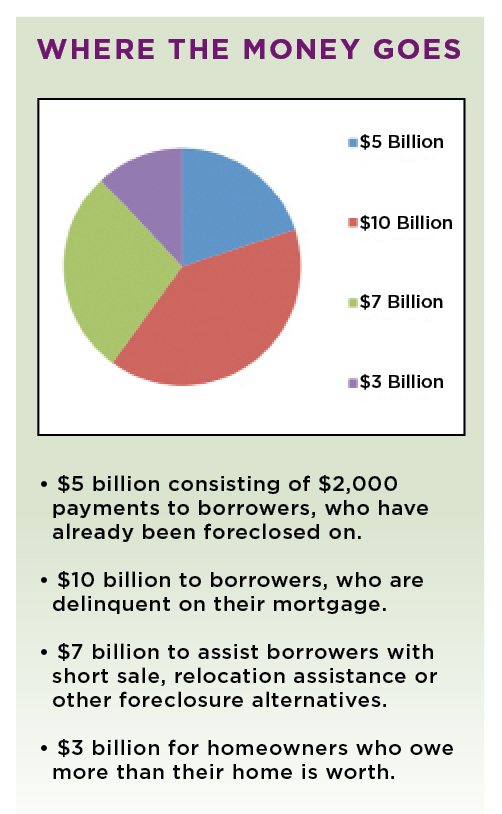

If you were foreclosed on between Jan. 1, 2008 and Dec. 31, 2011, you may be eligible for the onetime payment of $2,000.

Homeowners delinquent on their mortgage payments may be eligible for a loan modification. This is the largest portion of the settlement, with $10 billion set aside to help homeowners stay in their homes and avoid foreclosure.

If you are current on your mortgage payment but upside down on your mortgage, meaning you owe more than your home is worth, then you may be eligible within the $3 billion portion for a refinance of your current mortgage.

Where a loan modification or refinance is not an option, there is $7 billion, which will assist homeowners through the short sale process, and offer cash incentives at closing to help with relocation assistance and other foreclosure alternatives.

A $25 billion settlement sounds impressive, and it’s certainly a step in the right direction. Unfortunately, it won’t help the vast majority of homeowners, who are underwater in their mortgage. It is estimated 11 million households are underwater, and this settlement only will help 1 million of them. While it won’t make much of a dent in the overall housing crisis, it can be a great help to those individuals who qualify.

I have the full report on my Web site, along with the eligibility requirements.

Contact me today at Coldwell Banker Trails and Paths Premier Properties to find out if you qualify or for a free confidential consultation on the option available to you. Call (602) 571-6799, or send an e-mail to Lorraine@ArizonaShortSaleToday.com. Visit the Web site at www.ArizonaShortSaleToday.com.