Lorraine Ryall

The Phoenix housing market for 2014 was uneventful and pretty slow, with low supply but even lower demand.

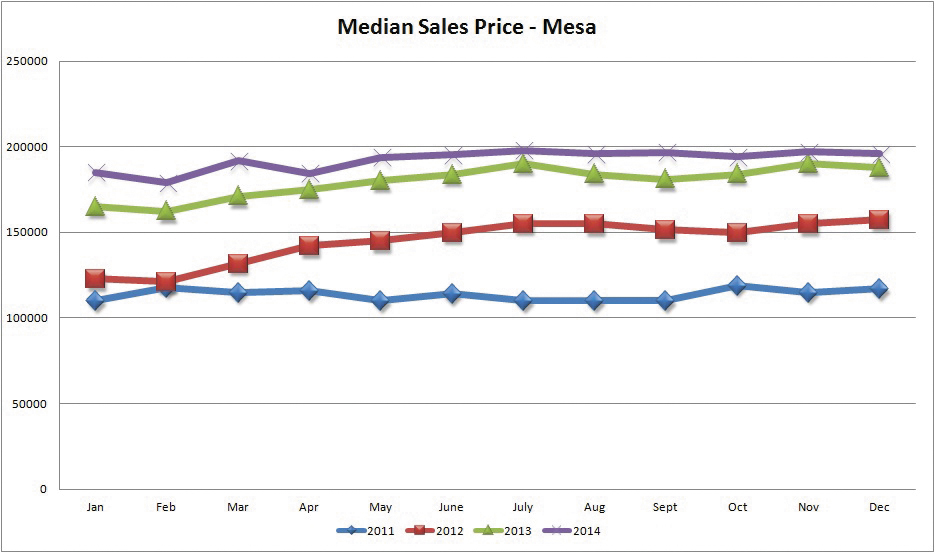

December’s median sales price for Mesa increased 5.95 percent over January 2014. However, the peak for 2014 was in July, with a median sales price of $197,900. December’s median sales price of $196,000 is down 1 percent from the summer’s peak.

2014 ended out on a high note with December sales ending stronger than expected with more than 11 percent increase over December 2013, which is a good way to start the New Year, and just one of the signs the market may be shifting in the seller’s favor. While the buyers still have a slight edge, with more supply than demand, the margin is thinning. There is a clear trend it is moving against them and heading in favor of the sellers. Supply decreased more than normal for December, and demand is showing some signs of life again, after being well below normal in 2014.

December luxury home sales soared. As a result, it was the best December since 2006, with 109 closed transactions across Greater Phoenix for homes priced at $1 million and above. This was an increase of 10 percent over December 2013.

Indicators Show 2015 Could Be a Strong Sellers Market

Mortgage applications made big moves recently, increasing 49.1 percent from one week earlier, and showcasing the largest jump since November 2008, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending Jan. 9.

January 2015 Greater Phoenix—In the first two weeks of January, there was a lower than average number of new listings coming on the market, and there was less supply than December. So far, we have the lowest number of active listings year to date since we started counting in 2000. Demand has started to increase. As of Jan. 15, supply and demand were almost balanced at 83.3 and 82.5 respectively. The key is going to be what will happen with supply and demand over the next few months. With supply already well below normal, and, if demand returned quickly to normal, sellers will regain the advantage, and prices could start to see some upward pressure building again.

New Lending Incentives Help Homebuyers in 2015

FHA Reduced Mortgage Insurance Premiums—The Federal Housing Administration (FHA) has reduced its annual mortgage insurance premium (MIP) by 0.5 percentage point, from 1.35 percent to 0.85 percent. This was effective on Jan. 26. According to the White House Fact Sheet on this announcement, this reduction will translate into an average savings of $900 annually on their mortgage payment. Existing homeowners who refinance into an FHA mortgage will see similar reductions to their mortgage payments, as well. Here is an example of how much this will save each month in the first year on a $250,000 loan.

Example:

Current MI rate 1.35 percent ($250,000 x 1.35)/12 = $281.25 monthly MI

New MI Rate 0.85 percent ($250,000 x .8 percent)/12 = $177.08 monthly MI

The new rate will reduce the FHA homebuyer’s monthly mortgage insurance by $104 per month on a $250,000 average loan amount. That is like giving a buyer another $20K to $25K in purchasing power.

Down Payment Conventional Loan of 3 Percent—Fannie Mae and Freddie Mac announced, in December, the return of the 3 percent down payment loan. However, it is only for first time homebuyers. A first time homebuyer is considered a buyer who has not had ownership in a home in at least the past three years. It does not, however, have to be the buyer’s first home.

Down payment—3 percent

Minimum Credit Score—620

First Time Homebuyer Requirement—Yes

Occupancy—Must be primary residence

The consensus of the analysts and several key indicators are all heading in the direction for 2015 to be a stronger year than 2014, and for the market to shift from being a buyer’s market to a seller’s market. At the time of writing this article, however, we were only two weeks into January, so it is too early to know for sure. Only time will tell, but it’s sure looking good.

Lorraine Ryall is a Multi-Million Dollar producer and a recipient of the Coldwell Banker International President’s Circle Award. For more information, call (602) 571-6799, or visit her website at www.Homes2SellAZ.com.