There are many reasons why our housing market is already off to a great start for the year, such as lower down payments and lower mortgage insurance premiums along with low interest rates.

However, another big factor is the fact Arizona was one of the worst hit states when the housing market crashed, with hundreds of thousands of homeowners going into foreclosure or short sale. The peak for foreclosures was in 2009, and, for short sales, it was 2011-2012. All these homeowners are now starting to come back into the market.

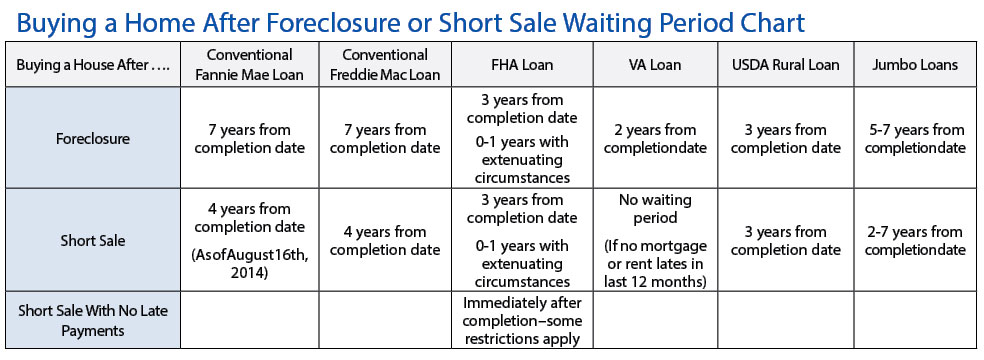

If you went through a foreclosure or short sale, below is a chart showing the waiting periods for each type of loan, so you know when you can purchase again. The waiting period starts when the home closed. So, make sure you check the close of escrow date or actual foreclosure date.

Some non-conforming loans are available to fill the gap for buyers who don’t want to wait to purchase again. These loans require a higher down payment and higher interest rate. Your first reaction is to say, “I don’t want a loan at that rate.” However, when you run the numbers, it actually can save you a lot of money, in the long run, as you can see below. Here is an example of one particular loan being offered today:

Only 1 day past foreclosure or short sale

- 20 to 30 percent down payment

- 30 year fixed rate mid 7s to low 9s

- No pre-payment penalty

If two years after foreclosure or short sale

- 20 percent down payment

- 30 year fixed interest rate mid- to high 7s

- No pre-payment penalty

The idea of these loans is not that you will be locked into the high rates for 30 years, but that you will refinance as soon as you have met the required waiting period. So, why would you consider getting a loan with such a high interest rate compared to today’s rate? For one, you can write off the interest on mortgage payments on your taxes. Second, let’s say you have three years left on a foreclosure wait period. The current rates are low, but are expected to increase over the next three years. Who knows, in three years, low 7s may not be a bad rate at all. You are locked in for 30 years at the rate, so maybe you won’t want to refinance. Your home value would have increased over three years. Here is a comparison of renting for three years and then purchasing a home, and if you purchased that same home today at the higher interest rate. (These numbers are just for the loan amount, and do not reflect any taxes or HOA fees, etc.)

Rent

- Renting a home valued around $300,000

- $1,500 a month rent

- $18,000 a year

- $54,000 over 3 years

- Purchases new home after three years for $350,000

- After 20 percent down payment

- $1,770 monthly mortgage payments at 6.5% for 30 years

Own

- $240,000 mortgage on a purchase price of $300,000, 20 percent down payment

- $1,761 monthly mortgage payment

- $21,132 a year

- $63,396 over three years, of which $56,869 is interest payments

- $17,060 tax deduction at 30 percent tax rate

- $47,287 additional equity in home, which is now worth $347,287 at 5 percent increase in property values a year (very conservative)

- $280,000 mortgage

- $1,476 monthly mortgage payment after refinancing current balance $233,472 at 6.5 percent interest rate for 30 years

As you can see by the above, although you will be paying a higher payment for three years, when you refinance, you will be paying $294 a month less for the next 30 years, which is a staggering $105,840 over the life of the loan, as your mortgage will be $47,000 lower due to the increase in home values since your purchase. So, if you have a 20 percent down payment, it might be worth having a chat with your lender, and running the numbers yourself before you blow it off because of the higher interest rates.

Please visit my website for the full article, or call me to discuss this further, and find out about current home values.

Lorraine Ryall is a Multi-Million Dollar producer and a recipient of the Coldwell Banker International President’s Circle Award. For more information, call (602) 571-6799, or visit her website at www.Homes2SellAZ.com.