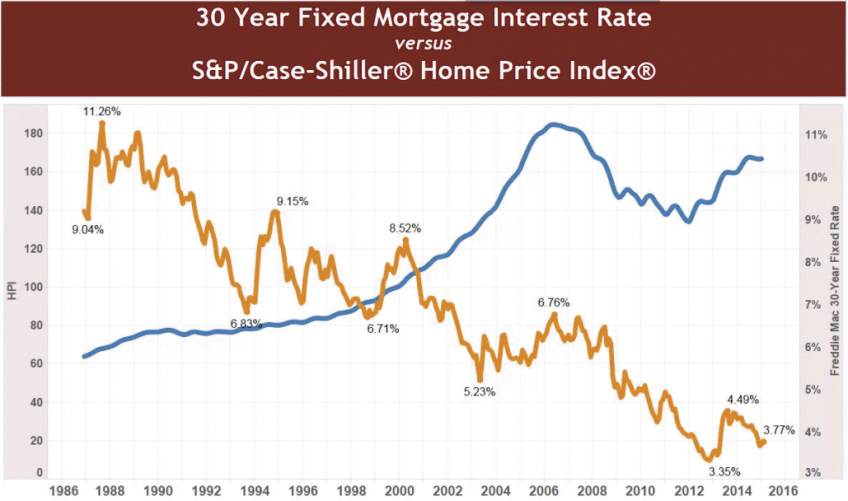

At first glance, over the course of decades, interest rates and home prices appear to have a negative correlation to each other. It would appear to make logical sense in assuming that as interest rates decline over time, affordability should be heightened. Therefore, demand should increase, resulting in rising prices. This theory gives credence to the feeling that if interest rates should rise, affordability would be reduced, lowering demand, and thus causing prices to decline.

The problem with this theory is it actually hasn’t happened in nearly 30 years. If we look at the six times interest rates have climbed significantly over an extended period of time since 1987, not once have prices declined in response. In fact, they have gone up. Conversely, when the interest rate has declined over a period of time, prices have either remained flat, gone up or gone down, giving us no distinct correlation.

The reason is the interest rate is only one indicator among many affecting demand. Demand is only 50 percent of the equation when predicting a price response as prices respond to both supply and demand together. In order for interest rates to have a direct influence on price, all other influencers would have to remain constant, which is a rarity.

The biggest influence on demand is how loose or tight banks are with their loan approvals. When banks are loose, they approve more people. The more people are approved, the higher demand. Once someone is approved, the interest rate will dictate what size home the individual will buy on average. As interest rates rise and fall, overall demand is affected minimally, but demand within price ranges shifts up and down.

In 2013, we saw the lowest historical mortgage rate at 3.35 percent. Ironically, while there was, indeed, an increase in demand, over 40 percent of transactions were cash and not involving a loan. While the interest rate was extremely attractive, lending practices were so tight that very few consumers could actually qualify for it. Therefore, the interest rate was not a major factor in the increased demand. Extremely affordable prices and investor optimism were the driving forces, which resulted in an influx of cash purchases.

In contrast, from 2004 through 2006, interest rates were 5.2 percent to 6.8 percent, and 90 percent to 94 percent of transactions were financed. While the interest rates were less attractive, nearly anyone could qualify for a mortgage. Excessively loose lending practices, combined with excessively high euphoria about the market, caused a large boost in demand beyond what the supply could handle, resulting in a sharp price appreciation.

GOOD NEWS FOR MESA

Inbound relocation, jobs and income are significant influences on real estate demand. Here are a few of Mesa’s developments along those lines this year:

APPLE announced the hiring of 500 employees, instead of the original 150, for its planned data center.

Special Devices Inc., a Japanese maker of airbags, announced the development of a new facility to employ 175 people by 2016.

Fiesta Mall announced the development of the Fiesta Corporate Campus, converting the vacant Macy’s store into modern office space. The 158,000-square-foot campus could bring 900 to 1,200 jobs.

Autoline Industries plans to invest $3.8 million into converting the vacant Sunkist packing plant, located at Broadway Road and Country Club Drive, into a manufacturing center and corporate headquarters.

A 21-acre farm, near the Superstition Freeway and Mesa Drive, will be developed as a commerce park with four office/industrial buildings.

A large employment center is planned near the Phoenix-Mesa Gateway Airport, which could bring 2,000 jobs in aerospace, e-commerce and manufacturing.

For additional information, call Ron Brown at (602) 618-9512, or visit the website at www.TrailsAndPaths.com. Coldwell Banker Trails and Paths, serving the East Valley for the past 16 years, is located in The Village at Las Sendas.